The U.S. economy posted a stunning drop of 0.1 percent in the fourth quarter, defying expectations for slow growth and possibly providing incentive for more Federal Reserve stimulus.

The economy shrank from October through December for the first time since the recession ended, hurt by the biggest cut in defense spending in 40 years, fewer exports and sluggish growth in company stockpiles.

Oh, goody -- more Fed stimulus! Oh, and damn that George W. Bush. If he would only stop causing sluggish growth in company stockpiles, all would be better.

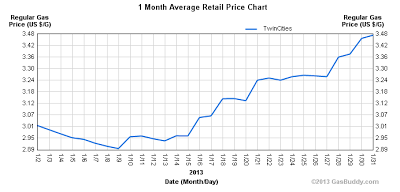

People aren't feeling very good about things at all right now. Everyone has noticed that the payroll tax holiday is over and they have less money in their paychecks. Meanwhile, the price for a gallon of gas has gone up over $0.60 here in the Twin Cities in the last three weeks.

|

| It's a gas |

12 comments:

How could we have known?

Oh well, What Difference Does It Make?(tm)

How could we have known?

Oh well, What Difference Does It Make?(tm)

If you're spending 4+% of your GDP on the military, it is rather hard to cut that substantially without knocking a dent in overall growth...unless you have robust growth elsewhere.

And if you have robust growth overall, good luck finding the political will to cut the military.

If you're spending 4+% of your GDP on the military, it is rather hard to cut that substantially without knocking a dent in overall growth...unless you have robust growth elsewhere.

Hard to do anything when only 4% of the GDP is under discussion, too.

Any chance our great esteemed leader has been cooking the books?

Some are saying that cutting government spending caused this contraction. Wouldn't that be another way of saying that the government's borrowing has been masking the true state of the economy? I think it's important to remember that borrowing is different than picking a yearly trillion off a money tree.

Hard to do anything when only 4% of the GDP is under discussion, too.

A-That's simply not true. If sequestration hits, it will hit everything. Just taking what I can speak to directly, if NIH (just over 1% of federal spending) contracts by the amount talked about, there will be a generation of very expensively trained bartenders and baristas.

B-You can't have it both ways. It is disingenuous to demand that spending be reigned in on one hand and then blame the people that do it for impacting the economy on the other. It's a simple fact that federal spending is a significant contributor to the overall economy, at least in terms of how we measure it (to which I will add that W.B. may be onto something.)

We can bitch and moan about how it ought not be that way, but the fact remains that you cannot drastically cut federal spending without affecting the economy, especially in the short term (which is what we're talking about, here).

A-That's simply not true. If sequestration hits, it will hit everything. Just taking what I can speak to directly, if NIH (just over 1% of federal spending) contracts by the amount talked about, there will be a generation of very expensively trained bartenders and baristas.

Talented, expensively trained people can only get work as bartenders and baristas in the private sector? Not sure I agree 100% with your detective work on that one. I have a feeling that a lot of people with an NIH background would add significant value to any number of private sector concerns.

B-You can't have it both ways. It is disingenuous to demand that spending be reigned in on one hand and then blame the people that do it for impacting the economy on the other. It's a simple fact that federal spending is a significant contributor to the overall economy, at least in terms of how we measure it (to which I will add that W.B. may be onto something.)

I'd argue that WBP is on to most of it. The reality is that the government now is about 25% of GDP. That's really not sustainable in the long term.

There's going to be pain no matter what we do. I don't think anyone disputes that. But we're going to have to go through the pain sooner than later, because future generations aren't going to be able to pay for our profligacy. Which means they won't.

Not entirely disingenuous.

1) Further regulation has also been a drag on the economy. But this administration has not taken steps to correct this.

2) It's politics. Obama has dodged the blame for lots of things. If he gets some blame for something that should have caveats... well, he's probably got it coming.

I exaggerate a little, but probably less than you think.

I exaggerate a little, but probably less than you think.

Well, yeah.

Brian, why look just at military spending and not the other 21% of GDP that's currently in government? We can't cut that spending for solar companies that keep going Chapter 7? No cuts for windmills? Nothing to fix the 22% shortfall in Medicare and Social Security under current projections?

"And if you have robust growth overall, good luck finding the political will to cut the military."

That's why George Bush (41) did it, as did Clinton, as did Truman, and as did Eisenhower--and all of them with a Congress of the opposite party.

Post a Comment